This paper is available on arxiv under CC BY-NC-SA 4.0 DEED license.

Authors:

(1) H. Wen, Department of Economics, University of Bath;

(2) T. Huang, Faculty of Business and Law, University of Roehampton;

(3) D. Xiao, School of Mathematical Sciences.

Table of Links

Relevant Blockchain Technologies

Advanced Models for Real-World Scenarios

Future Investigations, and References

4. Advanced Models for Real-World Scenarios

As we venture deeper into the intricacies of adapting blockchain models for practical, real-world applications, this section elucidates several advanced modeling techniques tailored to address real-life complexities. We commence by understanding the strategy of Allowing Agents to Skip Rounds, which presents flexibility in participation and caters to intermittent engagements. Transitioning to the realm of consumer interactions, we present Non-Random Consumer Selection, detailing methodologies for targeted and non-arbitrary engagement. Recognizing the dynamic nature of real-world systems, we then explore an Adaptive Model with Learning and Adjustment, ensuring our model remains agile, responsive, and self-evolving. Diving into motivational structures, the Contribution Incentive Mechanisms subsection delineates strategic rewards to galvanize proactive participation. Lastly, foreseeing the future of decentralized systems, we examine the Integration with Decentralized Autonomous Organizations, highlighting the fusion of our advanced models with self-governing, decentralized entities.

4.1. Allowing Agents to Skip Rounds

4.2. Non-Random Consumer Selection

As described in Section 3.2, when agents (C1) stake more credit points, they are more likely to respond actively to ratings due to the potential gains or losses brought about by the ratings from others. Logically speaking, agents who are willing to stake more credit points are more likely to meet the needs and expectations of consumers. Owing to the transparency of staking information, consumers tend to prefer producers who have staked more credit points due to the nature of risk aversion [60, 61, 62, 63, 64]. To initially implement this model, which integrates non-random consumer selection, we can adopt a method wherein, in each round, agents who stake fewer credit points not only have a higher probability of being bypassed for their actions, but also increase the likelihood of being bypassed by other agents for evaluations.

4.3. Adaptive Model with Learning and Adjustment

In the intricate realm of reputation systems, the actions of agents are influenced by both their past experiences and the ratings received from their peers. This section delves into the complex interplay of these factors, with a focus on the dynamics of staking in response to observed outcomes.

4.3.1. Self-Staking and Adjustment Based on Ratings

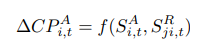

In the development of our reputation system, agents are characterized by their actions and ratings across different rounds of interaction, each denoting a time step in the system. Agents engage in actions, staking a certain amount of credit points to signal their confidence or commitment. However, not every agent is obligated to perform an action or provide rating in every round, allowing for a more general and flexible model representation. The rating provided by other participants in the system can be either positive or negative and subsequently influences the credit point balance of the agent in focus. This change in credit points is modulated by the initial stake of the agent and the stake accompanying the rating.

Where:

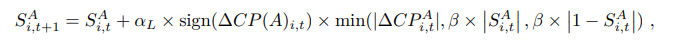

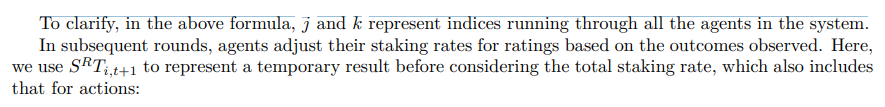

In the subsequent round, the agent adjusts their action based staking on the outcomes they observed:

4.3.2. Staking on Others and Adjustment Based on Outcomes

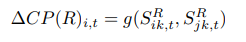

Agents also evaluate the actions of their peers, staking credit points on their evaluations. The magnitude of their stake amplifies the gains or losses they incur, contingent on the congruence of their evaluations with the consensus.

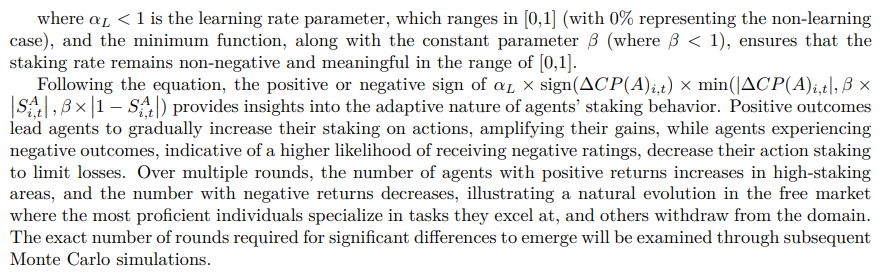

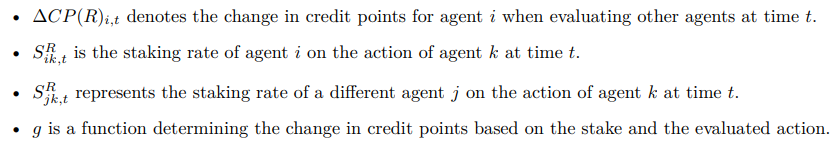

For an evaluation by agent i on agent k’s action at time t, the change in credit points is represented as:

Where:

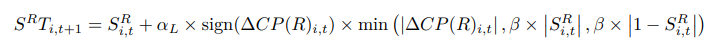

Subsequently, to ensure that the total staking does not exceed 100%, additional constraints are applied:

where αL < 1 is the learning rate parameter, which ranges in [0,1] (with 0% representing the non-learning case), and β < 1 ensures that the staking rate remains non-negative and within the [0,1] range.

This dual-layered rating and adjustment mechanism induces a dynamic evolution of staking actions in the system, thereby ensuring adaptability and responsiveness to the continuously shifting landscape of agent actions and evaluations.

In summary, understanding and modeling the dynamics of actions and ratings is crucial in predicting the evolution of staking systems, and our approach, combining psychological insights, economic reasoning, and rigorous mathematical modeling, offers a comprehensive view of the potential outcomes in such systems.

4.4. Contribution Incentive Mechanism

Enhancing the robustness and sustainability of the reputation system requires more than just leveraging its intrinsic advantages, such as more authentic ratings and demonstrated integrity. It is equally crucial to incentivize those participants who bring significant positive externalities to the platform.

A positive externality [65, 66] arises when the actions of an individual or firm confer benefits on others without being compensated for them. A standard illustration from economics is the realm of education: individuals who invest in their education not only gain personal advantages but also indirectly bestow broader societal benefits, like spurring productivity and innovation.

Within our reputation system’s framework, such positive externalities could emanate from:

• Direct Investment: Participants contributing directly to the platform aid its development and expansion. Such contributions can manifest in diverse forms, whether financial resources, technical know-how, or other crucial assets. For instance, backers financing the inception of novel features can amplify the platform’s capabilities, thereby magnetizing a larger user base. This prospect aligns with the evident interest of traditional financial entities that are keen on supporting innovative blockchain ventures or other forms of alternative finance [67, 68]

• Liquidity Provision: By ensuring seamless transactions and bolstering market efficiency, liquidity providers hold paramount importance. In the sphere of decentralized finance (DeFi), they are indispensable, pouring assets into liquidity pools to facilitate smoother trade operations while reaping returns for their contributions. Furthermore, it’s worth considering tailored incentive schemes for liquidity providers within centralized cryptocurrency exchanges, which often resonate more with users less versed in blockchain intricacies. Established financial institutions, as well as individual economists, advisors, and analysts, are progressively showing interest in exploring or trading in cryptocurrencies [69, 70, 71].

• Community Engagement: An involved community is the backbone of a platform’s success, as they amplify its virtues, actively partake in governance, and regularly offer feedback. A fervent user community can catalyze widespread adoption, inspire collaboration, and engender a shared sense of purpose among its members.

4.4.1. Modeling Externality Incentives

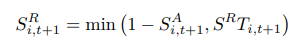

To incorporate externality incentives into the model, we introduce an additional parameter, γ, representing the impact of positive externalities on the reputation of agents. The total reputation of an agent i in round t can be expressed as:

4.5. Integration with Decentralized Autonomous Organizations

Once both the reputation system and the contribution incentive mechanisms have been simulated and rigorously tested without any issues, further development of the blockchain can be driven by the route of a DAO (Decentralized Autonomous Organizations) [72, 73, 74, 75]. In a Decentralized Autonomous Organization (DAO) model, user engagement is enhanced in two significant capacities. Firstly, as users, they execute actions, conduct trades, and cast ratings. Secondly, they serve as governors, casting votes on rule changes and deciding the overall direction of the blockchain. Their dual role ensures alignment with the reputation system’s success, as the platform’s growth and sustainability directly impact their benefits.

Drawing inspiration from existing blockchain projects can expedite the integration of DAO principles into our reputation system. Aragon, for instance, specializes in providing tools and a platform for decentralized organizations to operate [76, 77]. It offers a suite of applications and services that streamline the creation and management of decentralized autonomous organizations, thereby removing many of the traditional barriers to entry. On the other hand, Tezos represents a self-amending blockchain where decisions about protocol upgrades are made through on-chain governance, relying on stakeholders’ voting [78, 79]. Stakeholders can propose, select, or vote on amendments, allowing the blockchain to evolve and adapt without the need for a hard fork. Adapting elements from Aragon’s specialized DAO solutions and Tezos’ self-evolving structure can help our reputation blockchain achieve the desired autonomy and adaptability, ensuring long-term relevance and resilience.

Lead image by Terry on Unsplash