This paper is available on arxiv under CC BY-NC-SA 4.0 DEED license.

Authors:

(1) H. Wen, Department of Economics, University of Bath;

(2) T. Huang, Faculty of Business and Law, University of Roehampton;

(3) D. Xiao, School of Mathematical Sciences.

Table of Links

Relevant Blockchain Technologies

Advanced Models for Real-World Scenarios

Conclusions, Future Investigations, and References

3. Basic Model

In this section, we embark on a deep exploration of the foundational mechanisms underpinning our reputation-based blockchain. We initiate our discourse with the On-chain reputation system, elucidating how reputation metrics are embedded and maintained directly within the blockchain environment. Progressing further, we tackle the essential task of Connecting the real world to our digital framework, ensuring seamless integration and applicability. Recognizing the importance of clear foundational premises, we detail the Assumptions of the Gains or Losses for Any Agent, shedding light on the anticipated dynamics each participant might experience. This naturally leads us to an examination of the Distribution of Agent Actions within the system, offering insights into the varied interactions and behaviors exhibited by agents. Finally, we delve deep into the Action Analysis in Reputation Systems, providing a granular breakdown of the ripple effects and broader implications of agent activities within our reputation ecosystem.

3.1. On-chain reputation system

The idea is to introduce a cross-rating system in the blockchain-based free market. All agent actions will be rated either positively or negatively by others using staked credit points. The incentive for rating lies in potential future profits, as the staked credit points for each comment will earn a profit if it aligns with the general sentiment (positive or negative) of future comments. Conversely, they will incur a loss if future comments contradict the initial sentiment. The more credit points one stakes, the higher the potential profit or loss one stands to gain based on future ratings. Simultaneously, this also amplifies the impact on all previous ratings in the same direction, reinforcing them if they align and diminishing them if they oppose. Here, an agent is defined as a blockchain wallet holder. An agent can choose to stake any amount of its credit points between 0 and the balance in the wallet minus the transaction fee (negligible at Layer 2 of the Ethereum blockchain [53, 54]). An agent can also distribute the amount across multiple wallets, but this won’t provide any advantage over operating as a single entity since weight is determined by credit point amounts, not the number of agents.

The core proposition is to integrate a cross-rating system into the blockchain-based free market. Every agent’s action gets rated—either positively or negatively—by other agents leveraging staked credit points. The incentive for this rating mechanism emerges from potential future gains; the staked points for a comment will appreciate if subsequent comments resonate with its sentiment. In contrast, if future comments diverge, the staked points depreciate. The magnitude of potential gains or losses directly correlates with the number of staked credit points. Moreover, these stakes influence all preceding ratings in the same direction, either amplifying or attenuating them. In this context, an agent is delineated as a blockchain wallet holder. This agent can stake any quantity of its credit points, bounded between zero and the wallet balance after accounting for transaction fees. While agents can distribute their credit points across multiple wallets, this doesn’t confer any strategic advantage since the weight stems from the quantity of staked points, not the agent count.

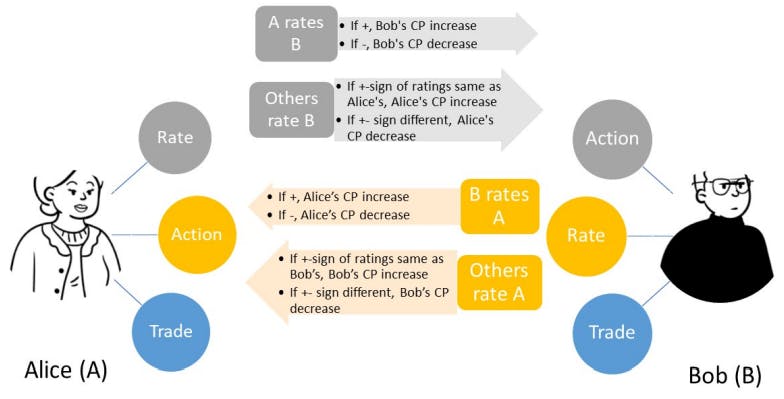

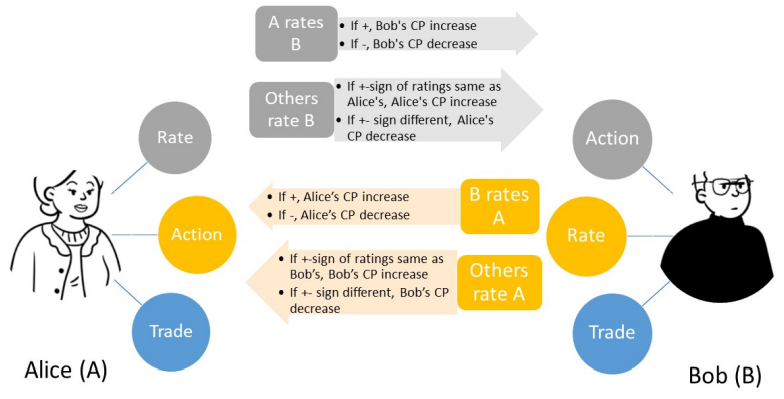

Figure 1 showcases an archetypal interaction round among agents within the reputation system. In any given round or block, agents, be it Alice, Bob, or any other participant, can partake in a mix of actions, ratings, or trades. For instance, if Alice rates Bob’s action positively in a round, Bob garners positive returns. On the other hand, a negative rating imposes a loss on Bob. Other agents can similarly rate Bob’s action within the round, influencing his credit point balance based on the rating’s nature.

When delving deeper into ratings, if an agent’s rating of Bob’s action aligns with Alice’s sentiment, both Alice and that agent benefit. However, conflicting ratings lead to losses for both parties.

The dynamic nature of potential gains and losses, contingent upon future ratings, fosters authentic feedback from agents, mitigating false ratings. Given that a significant portion of these ratings are genuine, the ecosystem offers a tangible advantage over traditional online platforms, which often grapple with counterfeit, low-cost ratings. Over time, this advantage is projected to burgeon, drawing an expanding user base. As the positive reinforcement loop of ratings solidifies, the continuously growing influence of the reputation system will inspire participants to proactively contribute, transforming these ratings into the system’s cornerstone. Such inherent positive externalities vouch for the sustainability of this reputation system, setting it apart from numerous other blockchain paradigms that lean heavily on credit point vesting, such as the renowned Chainlink 2.0 [18].

3.2. Connecting the real world

Following the introduction of ”soulbound credit points” by Ethereum’s co-founder, Vitalik Buterin [55, 56], and Elon Musk’s vision of integrating blockchain with Twitter accounts [57], a unique opportunity arises to associate each wallet address from the on-chain reputation system with a specific individual or entity in the real world. This association implies that actions undertaken offline could be evaluated, and these evaluations could subsequently result in tangible gains or losses based on evolving collective ratings. As blockchain continues to evolve and integrate with real world including Real World Assets (RWAs) [58, 59] via oracle or similar mechanisms, an increasing number of high-value economic activities are likely to find connections to the blockchain.

Given the promising potentials discussed in Subsection 3.1, individuals with a higher risk tolerance might be incentivized to link their real-world actions to their blockchain wallet addresses. On the other hand, participants of the reputation system, essentially the wallet holders, are the ones recognizing the value of this association and are willing to submit their ratings in anticipation of future benefits. This sentiment is particularly pronounced during the initial phases of the project. Although speculators may invest in credit points expecting them to appreciate in value, they don’t possess a strong economic motive to submit misleading ratings. As a result, their activities should not compromise the system’s functionality.

We’ll now transition from these theoretical underpinnings to a practical application, beginning with a rudimentary model. Let’s consider the following categories of agents participating in the reputation system:

C1. Agents with Actions

C2. Rating Participants

C3. Investors

Any given agent can belong to one, two, or all three of these categories simultaneously.

C1 agents, due to potential gains or losses stemming from others’ ratings, are more likely to be responsive to rating if they have staked a higher number of credit points. It is logical to assume that agents staking more credit points will prioritize meeting consumer expectations. Since this staking information is transparent, consumers will naturally gravitate towards producers who have staked more credit points, creating an initial incentive for credit points purchase when someone decides to join the reputation system. While producers can also rate consumers, this mechanism naturally promotes responsible action across the board. To preserve individual privacy and provide flexibility in engagement, the model permits C1 agents to choose the amount they would like to stake – anywhere from zero to their full wallet balance (minus transaction fees) – for any given action they want to be rated on. The staking information is transparent on the chain, and therefore consumers may also use this information when choosing providers. They are more likely to prefer those who have staked more credit points due to the reasoning above.

C2 agents similarly determine their staked amounts based on the confidence level of their beliefs when providing ratings. Since these agents are subject to potential gains or losses depending on the conformity of others’ ratings to the actions they have rated, they are incentivized to rate in a responsible and genuine manner.

C3 agents, or traders between the credit points and other assets at anywhere external to the reputation system, are individuals who primarily buy or sell credit points without engaging in other actions within the system. Their actions are largely inconsequential to the reputation system’s functionity. However, traders could indirectly benefit the system in its initial phase by driving up credit point prices with their purchases.

3.3. Assumptions of the Gains or Losses for Any Agent

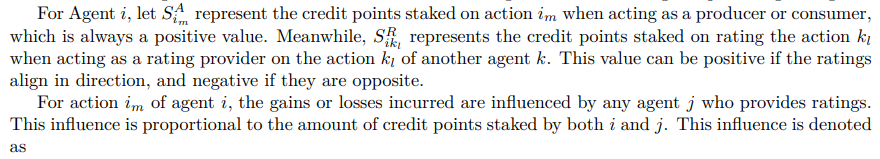

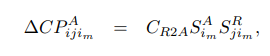

Consider an agent i as a general example of any agent. We categorise its involvement in the reputation system into three parts: functioning as a C1, C2, and C3. Considering trader agents categorised as C3 are not directly affecting the credit point-number-based gains or losses of any other specific agents, we now focus on C1 and C2 categories and denote them as ”A” for action agents and ”R” for agents providing ratings.

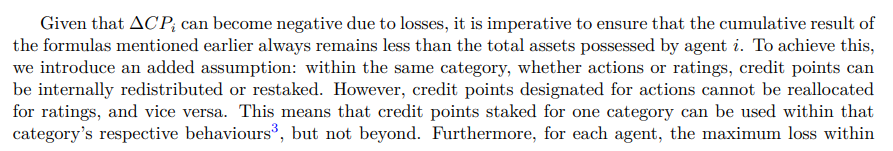

a category cannot exceed the credit points allocated for that specific category. This stipulation implies that every agent must earmark a specific portion of their credit for each staking category from the outset, and these cannot be liquidated until they are unstaked. In more advanced models, this foundational assumption can be replaced with intricate mechanisms that more closely mirror real-world scenarios, ensuring that total losses never surpass assets, even though total gains might exceed them.

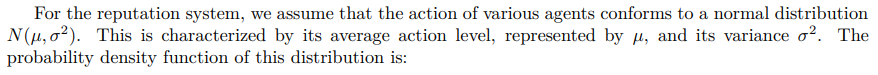

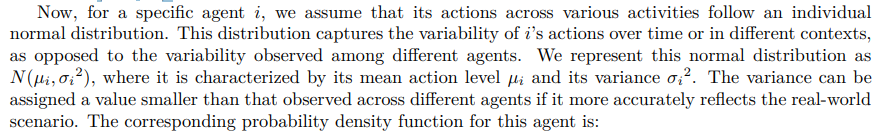

3.4. Distribution of Agent Actions

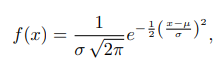

where x ∈ (−∞, ∞).

where, once again, xi ∈ (−∞, ∞).

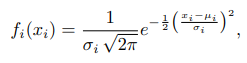

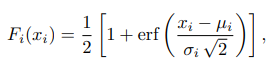

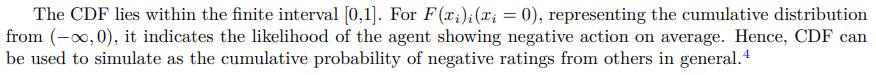

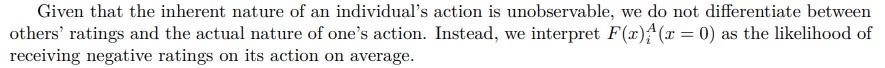

Although this is an infinite interval, its cumulative distribution function (CDF) is:

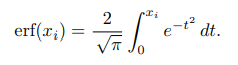

where the error function is defined as:

3.5. Action Analysis in Reputation Systems

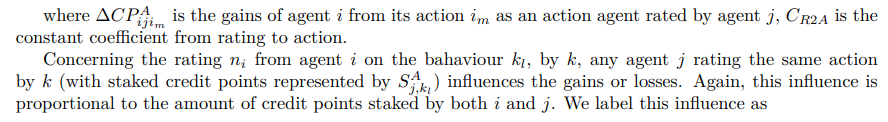

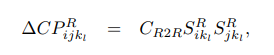

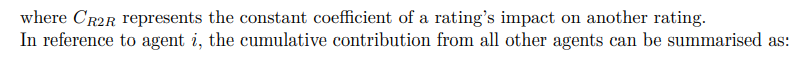

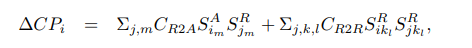

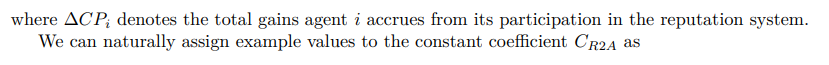

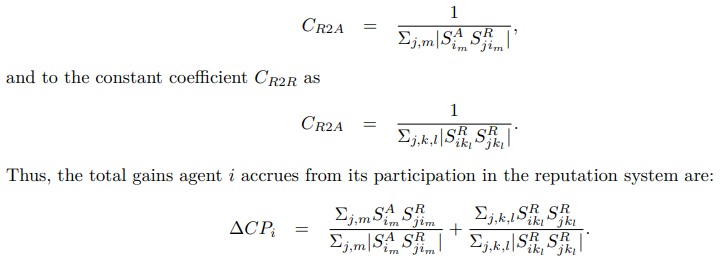

Considering a reputation system where agents rate each other based on action, we posit that an agent’s rating can either be positive or negative. Each agent’s action and rating can influence the gains or losses for others. Thus, the total gains agent i accrues from its participation in the reputation system are given by formula (6)

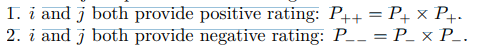

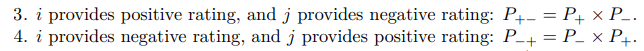

Let us denote the probability of agent i providing a positive rating as P+ and that of negative rating as P−. The joint probabilities of rating interactions between i and j under different scenarios are:

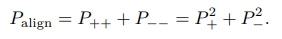

The chances that rating from two agents align in sentiment (either both positive or both negative) is:

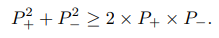

To ascertain whether the majority of agents will benefit from such a system without specially designed favourable mechanism, we examine the relative magnitude of probabilities for congruent rating (both positive or both negative) against incongruent rating. Specifically, we need to verify:

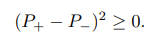

Breaking it down and reordering:

By the fundamental properties of real numbers, the square of any real number is always non-negative. This implies that the combined probability of agents giving congruent rating (either both positive or both negative) will always be at least as high as that of giving incongruent rating. Thus, when agents’ rating aligns, the majority in the system stands to benefit. This dynamic promotes a system where congruent ratings are more prevalent than incongruent ones, underscoring the collaborative nature of such reputation systems. In theory, this mechanism should encourage agents to participate actively in ratings. We can use Monte Carlo simulations to determine whether this is noticeable in practice.